All about Hsmb Advisory Llc

Hsmb Advisory Llc Fundamentals Explained

Table of Contents3 Easy Facts About Hsmb Advisory Llc DescribedHsmb Advisory Llc for BeginnersHsmb Advisory Llc Things To Know Before You Get ThisThe 7-Minute Rule for Hsmb Advisory Llc

Life insurance policy is specifically vital if your household hinges on your salary. Industry professionals suggest a policy that pays 10 times your annual revenue. When approximating the amount of life insurance policy you need, consider funeral service expenses. Then compute your household's everyday living costs. These may consist of home loan payments, impressive finances, credit history card debt, tax obligations, youngster care, and future college costs.Bureau of Labor Data, both partners functioned and generated revenue in 48. 9% of married-couple families in 2022. This is up from 46. 8% in 2021. They would be most likely to experience economic difficulty as a result of among their wage earners' fatalities. Wellness insurance coverage can be gotten with your employer, the government health and wellness insurance industry, or private insurance policy you buy for on your own and your family by calling wellness insurance policy firms straight or undergoing a health and wellness insurance representative.

2% of the American population was without insurance protection in 2021, the Centers for Disease Control (CDC) reported in its National Center for Health And Wellness Statistics. More than 60% got their coverage via an employer or in the personal insurance policy industry while the rest were covered by government-subsidized programs consisting of Medicare and Medicaid, veterans' benefits programs, and the federal industry established under the Affordable Care Act.

Fascination About Hsmb Advisory Llc

If your revenue is reduced, you might be one of the 80 million Americans that are qualified for Medicaid.

According to the Social Safety Management, one in 4 workers getting in the workforce will become impaired before they get to the age of retirement. While health insurance pays for a hospital stay and medical costs, you are commonly burdened with all of the costs that your paycheck had covered.

This would be the most effective alternative for securing inexpensive disability protection. If your company doesn't use long-term coverage, right here are some points to consider prior to acquiring insurance coverage on your very own: A policy that ensures income replacement is ideal. Numerous policies pay 40% to 70% of your revenue. The cost of impairment insurance policy is based on lots of aspects, consisting of age, lifestyle, and health and wellness.

Prior to you acquire, read the great print. Many plans call for a three-month waiting duration before the coverage kicks in, offer an optimum of 3 years' worth of protection, and have substantial policy exclusions. In spite of years of renovations view publisher site in auto security, an approximated 31,785 people passed away in web traffic crashes on U.S.

Hsmb Advisory Llc Fundamentals Explained

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

Comprehensive insurance policy covers burglary and damage to your cars and truck due to floods, hail storm, fire, criminal damage, dropping objects, and animal strikes. When you fund your car or rent a cars and truck, this sort of insurance is mandatory. Uninsured/underinsured driver () protection: If a without insurance or underinsured chauffeur strikes your car, this coverage pays for you and your passenger's clinical expenses and might additionally make up lost revenue or make up for discomfort and suffering.

Employer protection is typically the most effective choice, yet if that is unavailable, get quotes from several companies as several provide discount rates if you buy more than one type of insurance coverage. (https://www.taringa.net/hsmbadvisory/health-insurance-st-petersburg-fl-your-ultimate-guide_5bpkou)

Hsmb Advisory Llc Things To Know Before You Get This

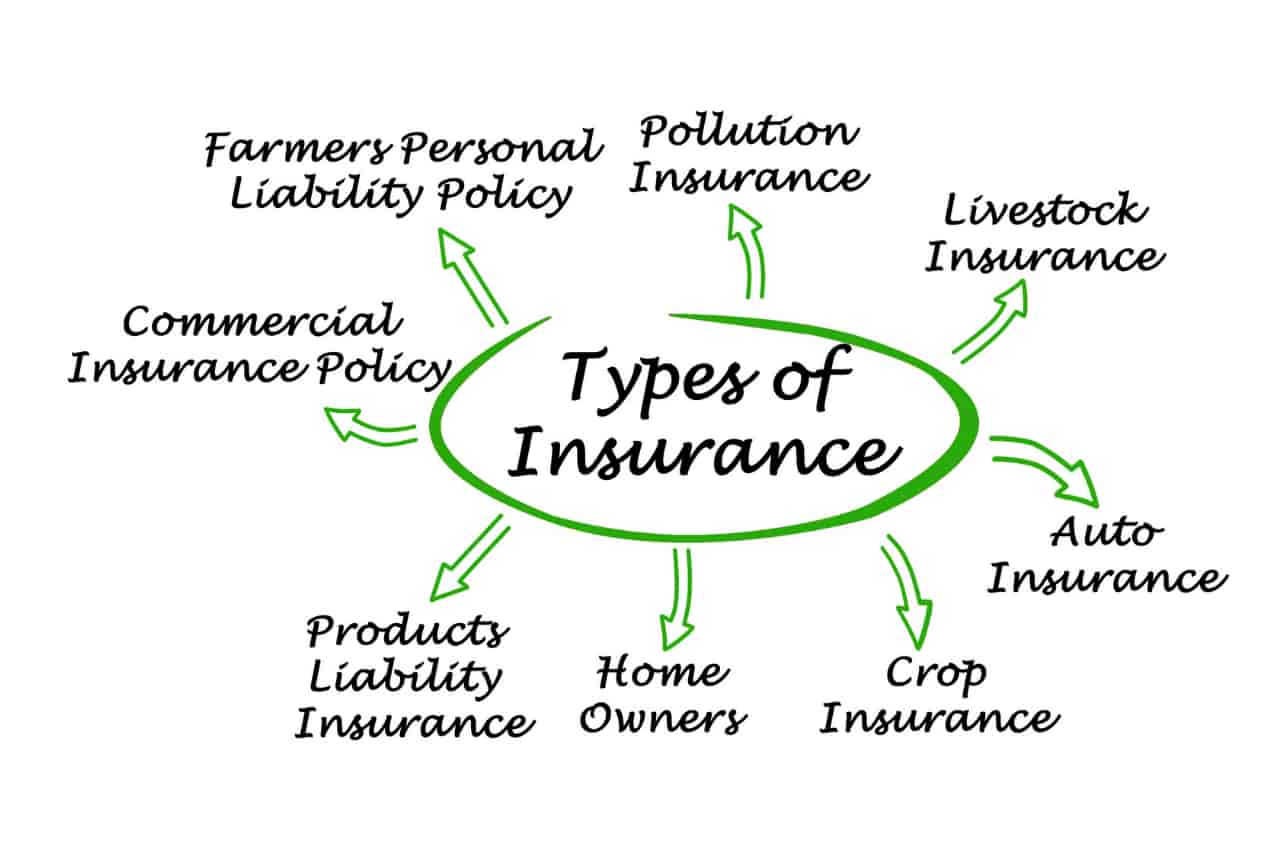

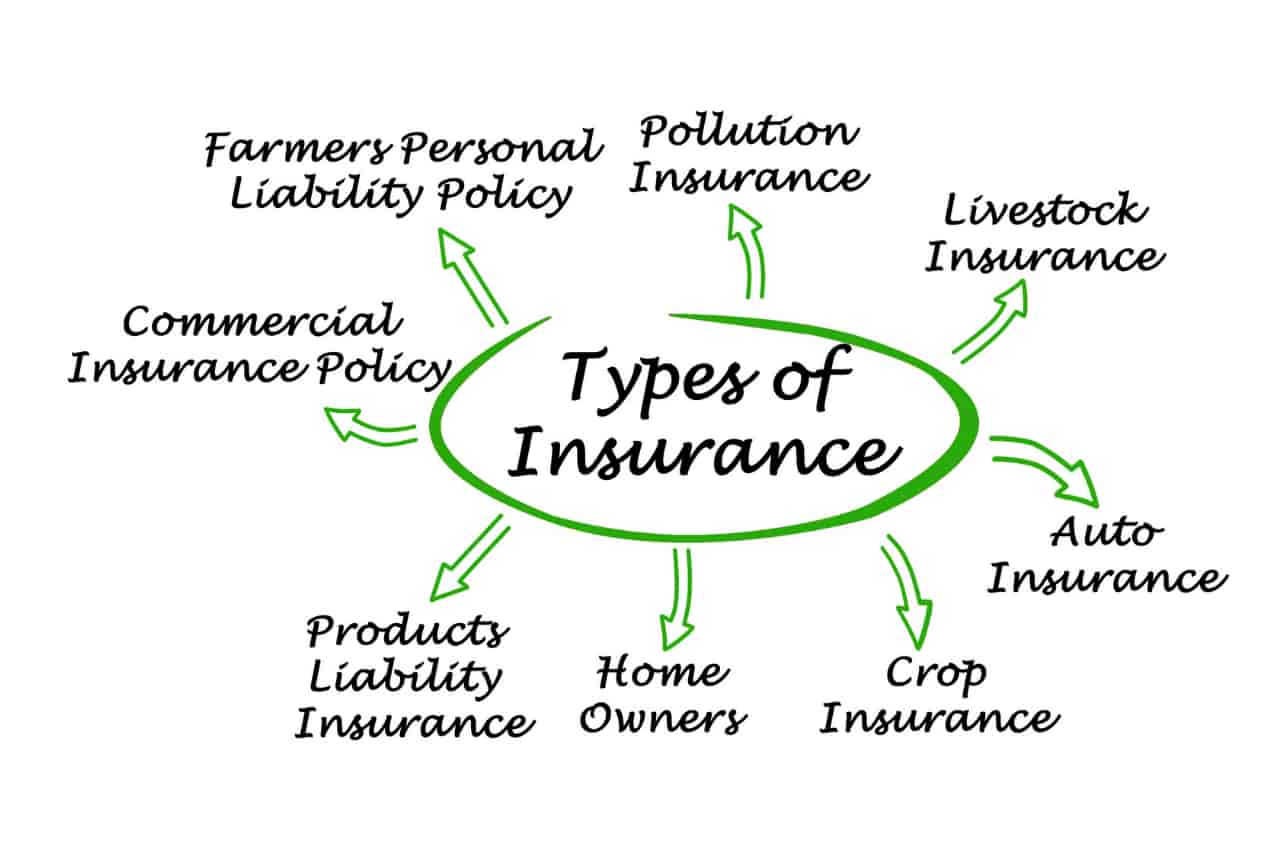

In between medical insurance, life insurance policy, handicap, responsibility, long-lasting, and even laptop insurance, the job of covering yourselfand considering the countless opportunities of what can happen in lifecan feel frustrating. Once you recognize the principles and make certain you're properly covered, insurance coverage can improve monetary confidence and wellness. Right here are the most essential types of insurance you need and what they do, plus a couple suggestions to prevent overinsuring.

Various states have various laws, but you can expect medical insurance (which many individuals get through their company), vehicle insurance (if you possess or drive a vehicle), and homeowners insurance policy (if you possess residential or commercial property) to be on the list (http://tupalo.com/en/users/6280892). Mandatory sorts of insurance coverage can transform, so check up on the most up to date regulations every so often, specifically before you renew your plans